European Hydrogen Storage: Key to Enhancing Energy System Adequacy and Security in PLEXOS

This blog is part of a series on hydrogen in PLEXOS, following our discussion on hydrogen transport modelling, which can be found here.

5 min read

Evgeniia Kirillova, Lucas Sens, & Dr. Paolo Farina : Mar 11, 2024 8:00:00 AM

In this blog focusing on Norway and Germany, we detail their crucial roles in the hydrogen economy—Norway as an emerging blue and eventually green hydrogen producer, and Germany as a major consumer and central figure in Europe's energy scenario. We further extend our discussion to the potential use for ammonia and blending hydrogen with natural gas, demonstrating PLEXOS' utility and value as a tool in navigating the hydrogen markets’ future.

Often heralded as the fuel of the future, hydrogen holds great promise for revolutionising our energy landscape. Its versatility, environmental friendliness and potential to mitigate climate change make it a critical component of the future energy mix. As the smallest molecule, hydrogen is challenging to transport and store. Due to its low molecular weight, hydrogen has a low volumetric energy density at typical ambient conditions, which means that a large volume is required to contain a given amount of hydrogen. This low volumetric density poses a multi-layered economic challenge for both stationary and portable, large industrial volume, transport.

Pipeline transport of hydrogen may become a viable and often used option for the efficient supply and distribution of hydrogen to end users in the future. Pipeline transport might be achieved through newly built and reproposed pipelines or blended with natural gas in retrofitted networks. However, there are significant economic costs and material challenges to retrofitting natural gas infrastructure that will carry both gas and hydrogen blends. Knowing what the economic costs and constraints on hydrogen transport systems are or are going to be is essential information for hydrogen market participants who need to make mission critical decisions and end user consumers who require high granularity, accurate price knowledge.

The latest version of Energy Exemplar’s European Hydrogen PLEXOS Dataset offers users a variety of options for creating a detailed view of the current and future hydrogen market. Whatever the transport requirements of a hydrogen modelling task, you can apply it using PLEXOS objects.

Current hydrogen transport infrastructure parameters and constraints are used as inputs and modelling approaches in our new European Hydrogen Dataset. Using PLEXOS as an experimental sandbox for understanding hydrogen transport scenarios, hydrogen market professionals at all levels- from analysts using short and medium-term planning capabilities for operations decision making and optimisation to corporate leaders using long-term planning to envision and progress solutions in the energy transition - can benefit from PLEXOS Hydrogen Transport Modelling.

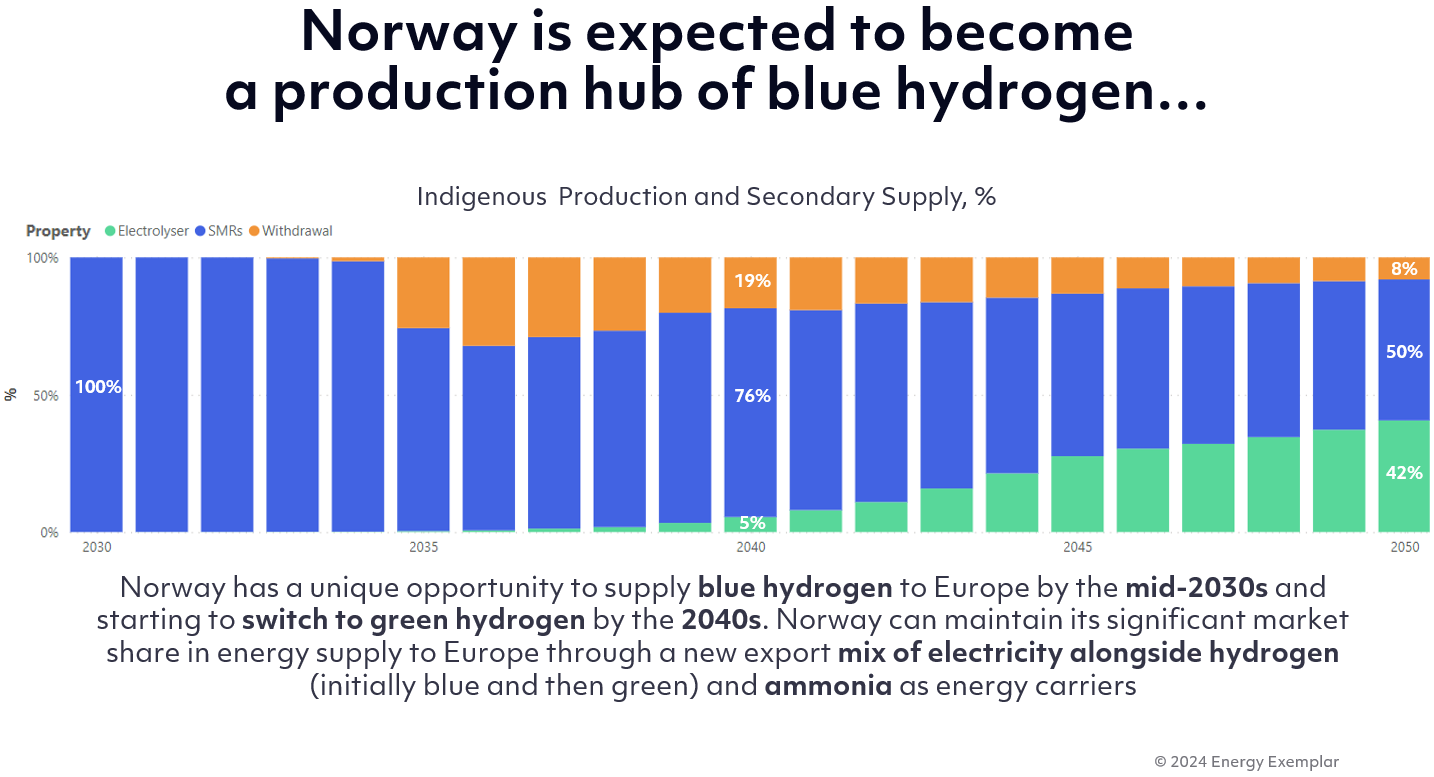

The shape and state of play for the hydrogen markets and economy can look significantly different across countries and vary by region or even geopolitics. Modelling results from our updated European Hydrogen Dataset show the potential optimum of the hydrogen production structure for each country. Looking at Norway as an example, we see a key potential role for the steam methane reforming process and an ample share of blue hydrogen production in Norway by the mid-2030s, with an initially small and then gradually increasing switch to green hydrogen production in the 2040s.

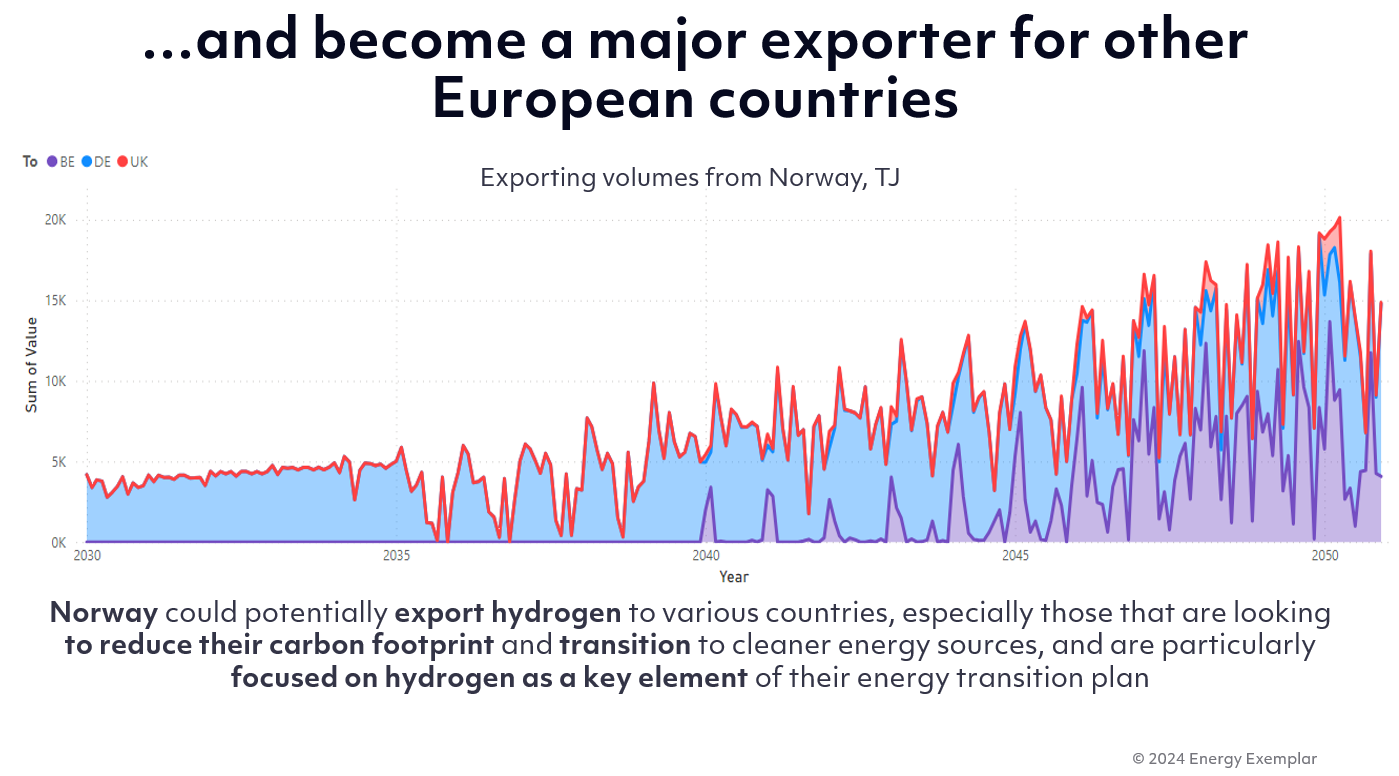

Known for its robust energy sector potential, Norway is poised to strengthen its prominent market share in supplying energy to Europe by exploring potential hydrogen pipeline routes to key destinations such as Belgium, Germany, and the UK. During periods of increased demand, we see how pipelines can be configured to accommodate increasing supply of hydrogen. Among the primary, optimum supply routes, Germany emerges as one of the key hydrogen destinations.

Known for its robust energy sector potential, Norway is poised to strengthen its prominent market share in supplying energy to Europe by exploring potential hydrogen pipeline routes to key destinations such as Belgium, Germany, and the UK. During periods of increased demand, we see how pipelines can be configured to accommodate increasing supply of hydrogen. Among the primary, optimum supply routes, Germany emerges as one of the key hydrogen destinations.

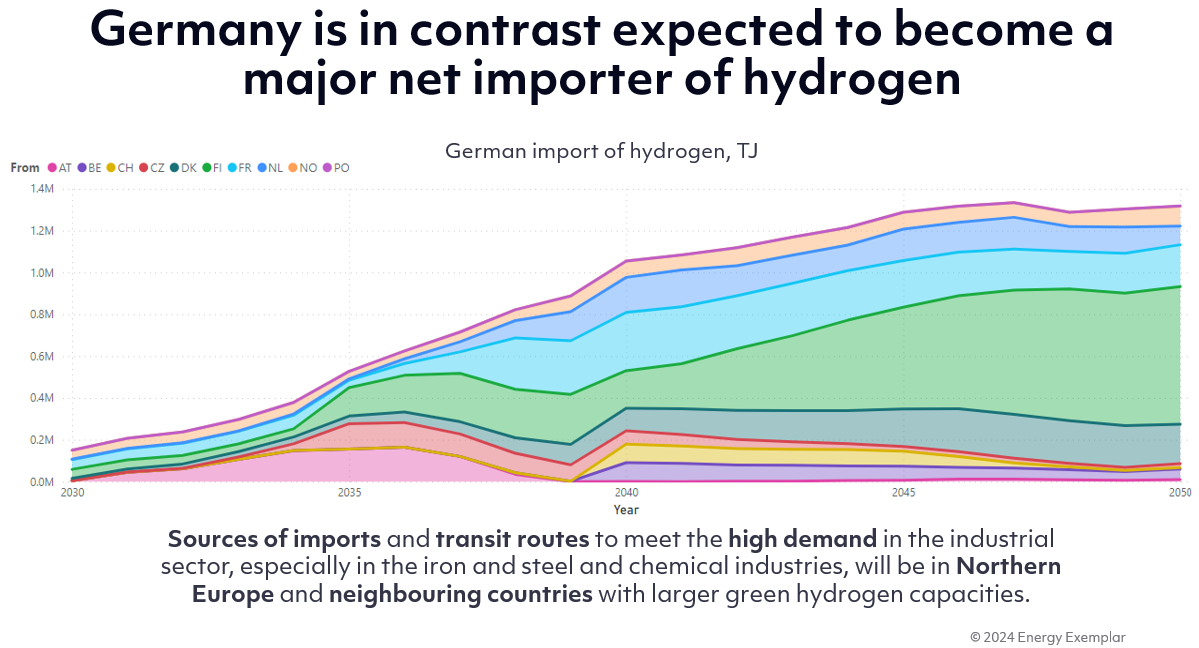

Our analysis of Germany's position as a key player in the future hydrogen market is based on the assumption that it will be the largest potential hydrogen consumer. Germany's importance rests not only on its large energy demand profile, but also in its outsized role as a central leader in the European energy economic landscape. German hydrogen demand is expected to be met by utilising the full infrastructure capacity of the fast-evolving hydrogen market. Based on ENTSOG’s TYNDP outlook2, which provides a European view on the progression of the hydrogen market, the Northern supply route will be used as one of the main import pipeline routes to meet German demand.

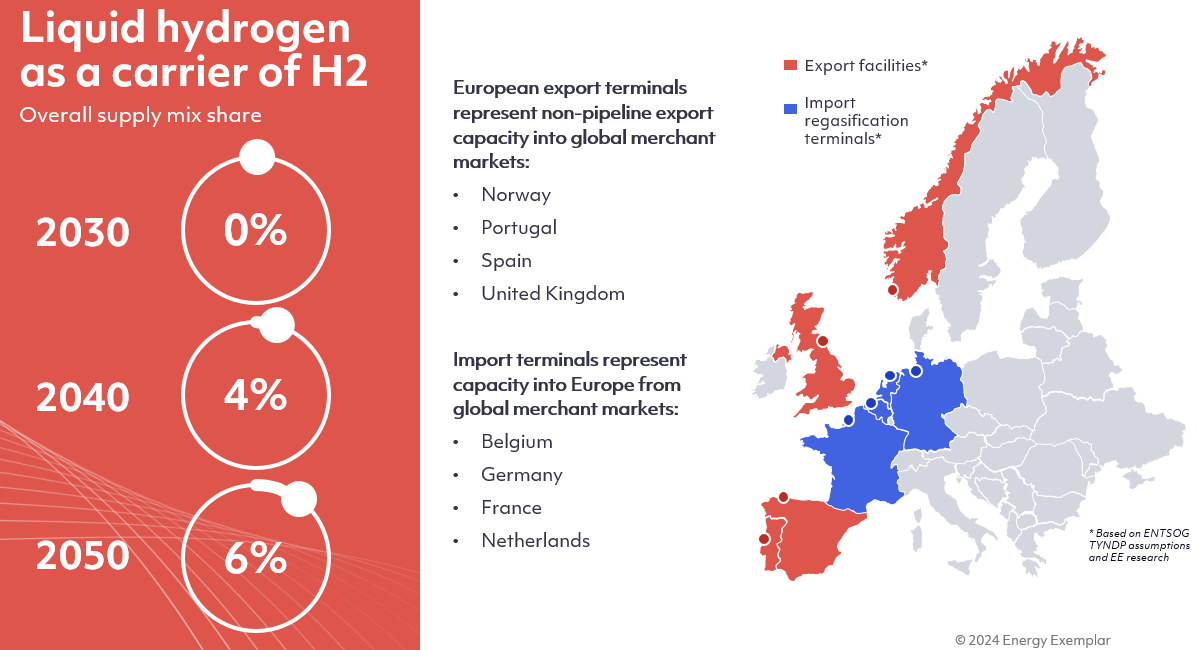

One promising means of transporting hydrogen is as liquid hydrogen. This type of transport is comparable to the transport of liquefied natural gas (LNG). However, the liquefaction point is significantly lower than that of LNG. Liquid hydrogen (LH2) and liquefied natural gas are both cryogenic liquids, meaning, they exist in a liquid state at extremely low temperatures. Liquid hydrogen has one of the lowest boiling points of any molecule occurring at about -253 °C, while LNG boils at temperatures typically in the range of -161 to -162 °C. This means that the effort and energy required to reach and maintain the liquid state of hydrogen is even higher than for LNG. In general, liquid hydrogen is a promising economic option for transport over medium distances, despite the challenges of developing import gateway infrastructure and the general lack of existing cryogenic containers for truck and rail and vessels.

The possibility of using liquid hydrogen transport to meet hydrogen supply needs is also modelled in the current release of the PLEXOS European Hydrogen Dataset. As various alternatives to pipelines emerge and demand for energy increases in different regions, liquid hydrogen is expected to play an increasingly important role in the broader supply landscape. This shift is being driven by several factors, including technological advances, environmental concerns and the need for reliable energy sources. Most imports are used to meet growing German demand and the UK is the largest exporter of liquid hydrogen.

The possibility of using liquid hydrogen transport to meet hydrogen supply needs is also modelled in the current release of the PLEXOS European Hydrogen Dataset. As various alternatives to pipelines emerge and demand for energy increases in different regions, liquid hydrogen is expected to play an increasingly important role in the broader supply landscape. This shift is being driven by several factors, including technological advances, environmental concerns and the need for reliable energy sources. Most imports are used to meet growing German demand and the UK is the largest exporter of liquid hydrogen.

Another possible use of existing infrastructure in hydrogen transport is the partial blending of hydrogen with natural gas in pipelines by creating gaseous mixes. Often referred to as "hydrogen-enriched natural gas" or "hythane" when a specific blend ratio is used, this blend could enable some existing infrastructure to be used as a transitional enabler of the European hydrogen economy. For example, in the final days of 2023, the UK government authorities published updated guidance about possible levels of hydrogen blending in existing pipeline networks. The Government has taken a strategic decision to support the addition of up to 20% hydrogen to the UK's gas distribution networks, recognising the demonstrated potential for strategic and economic benefits. The blend ratio refers to the proportion of hydrogen mixed with natural gas. The potential economic value of blending different percentages of hydrogen can be modelled and analysed in PLEXOS as scenarios with different inputs adding to the detail and range of analysis that can be studied and mined for insights with the PLEXOS European Hydrogen Dataset.

PLEXOS allows end users to input and model ammonia infrastructure as a hydrogen storage and transport option. Ammonia is potentially viable as a flexible, long-term hydrogen carrier and a zero-carbon fuel that can be integrated into a carbon neutral economy model. The capability to include all stages and parts of the hydrogen economy in long-range strategic models, that also include renewable energy market penetration, battery modelling, carbon capture processes and storage with further carbon and emissions pricing and forecasting is a significant evolution for strategy and corporate leaders who are looking to identify and potentially invest in game changing new businesses built for the energy transition.

Hydrogen transport is a diverse landscape, with options ranging from pipeline transport to cryogenic vessels and even ammonia carrier technology, offering promising prospects for the future of economic energy supply. With the recent updates to the European Hydrogen Dataset, PLEXOS users have a solid foundation with which to explore the emerging hydrogen economy, markets and its transport and storage infrastructure. Going forward, Energy Exemplar is committed to further improving PLEXOS and our datasets to reflect the evolving dynamics of these and other evolutionary elements of the energy transition.

To more deeply explore the topic of hydrogen energy and its impact on the global energy transition, we invite you to watch our exclusive on-demand webinar "How to fast track hydrogen and energy system and market modelling" presented by Tracey Granger, Head of Data and Dr. Paolo Farina, Gas Solutions Team Lead.

This blog is part of a series on hydrogen in PLEXOS, following our discussion on hydrogen transport modelling, which can be found here.

1 min read

As Europe positions itself for a significant transformation in energy paradigms, a critical question emerges: How will Europe meet strict carbon...