Battery Optimization and Valuation

PLEXOS allows energy investors to forecast energy pricing, battery storage profitability, merchant risk with unprecedented accuracy.

Valuing infrastructure and hard asset investments, especially emerging technologies, has never been more challenging in the energy sector.

Unlike other battery optimization models that make global assumptions regarding when to charge and discharge, PLEXOS optimizes charge and discharge rates based on real-world inputs as well as battery location on the grid. Location plays a crucial role on investment returns and valuation due to varying levels and types of renewable resources, grid congestion, and demand.

The unique characteristics of Battery Energy Storage Systems (BESS) enable such projects to solve for multiple applications such as peak shaving and load leveling, frequency and voltage regulation, power quality, reserve capacity, and renewable generation smoothing and ramp rate controls. While some investors could value a battery entirely on revenue from the ancillary service or capacity markets, Energy Exemplar clients have found that the most reliable path to maximizing economic benefit incorporates energy arbitrage into the valuation.

Optimizing energy arbitrage with battery storage and the long-term valuation of batteries requires a holistic understanding of battery placement on the energy grid. For this demonstration, we rely on an nodal model that includes all the factors that impact an energy system (including fuel prices, complexity of the transmission grid, different generation sources, including solar, wind, and thermal as well as variable demand), to create a real-world example.

We are interested in modeling a battery, named Fermi, with 90% charge efficiency and a 100% discharge efficiency. By factoring in a maximum power of 15 MW and an overall total capacity of 45 MWh, we can replicate a real-world battery asset.

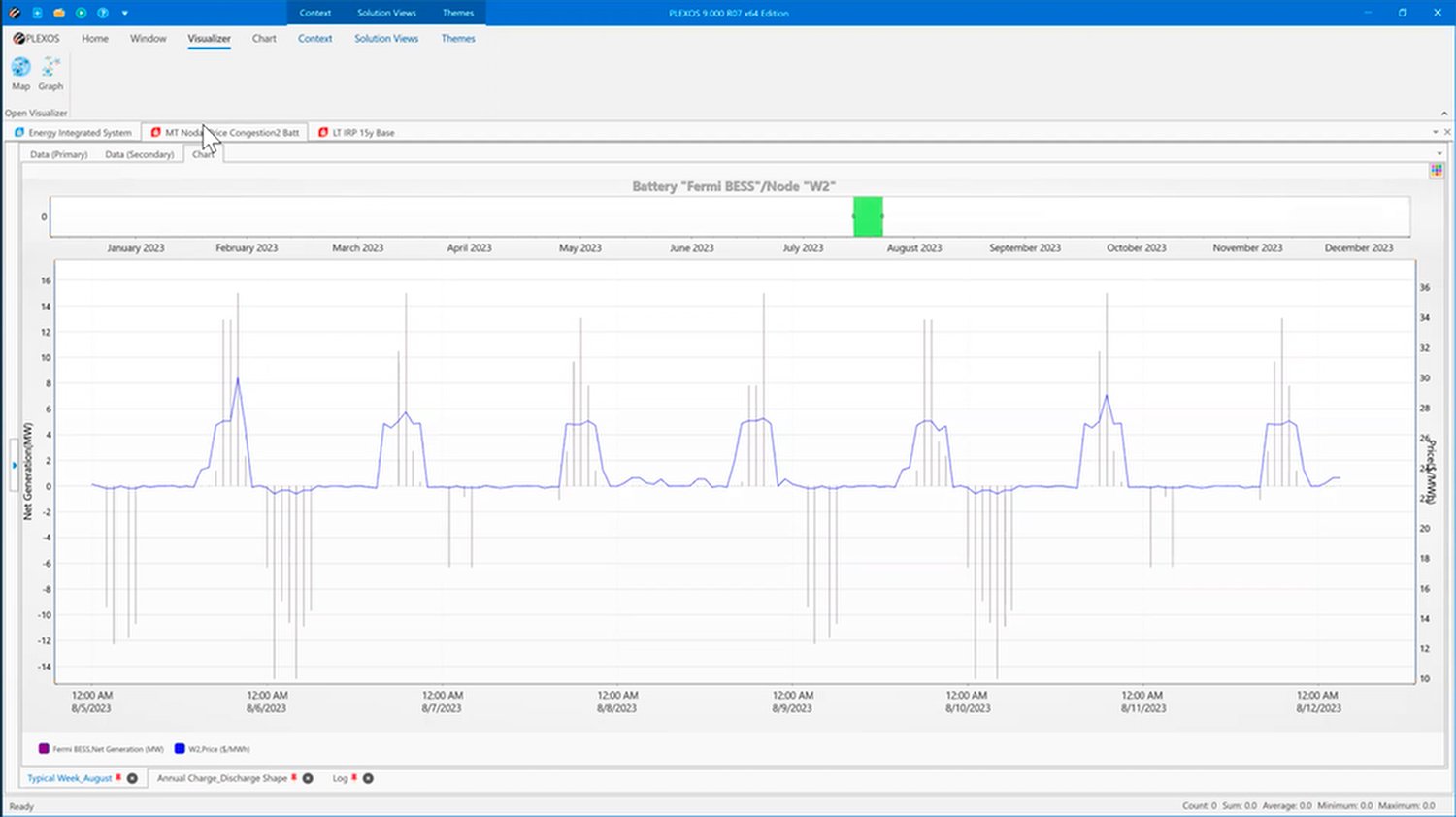

We start by examining energy pricing over a single week in August. PLEXOS enables us to identify optimal charge and discharge times to maximize returns. In the graph below, energy pricing is shown in blue. Where most models assume the daily frequency and amount of charge and discharge to remain constant, PLEXOS maximizes returns by charging at the lowest price points even when multiple days may elapse between charge cycles.

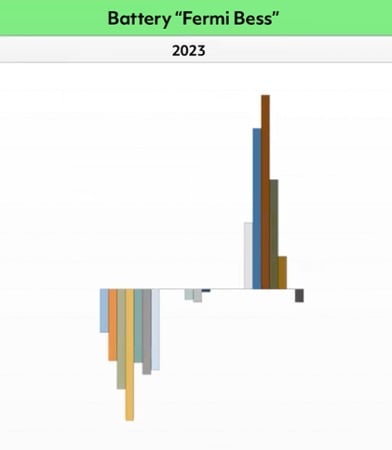

Examining the asset further, we can adjust our time scale to cover an entire year. Here, we can understand the shape of the asset utilization cycle expected to see from the battery.

Like the weekly analysis above, PLEXOS shows charging happens mostly in early morning and discharging occurs in late afternoon.

A yearly model also identifies additional charging opportunities. In this scenario, PLEXOS identifies charging opportunities created from high renewables generation in mid-middle of the day and low demand late at night.

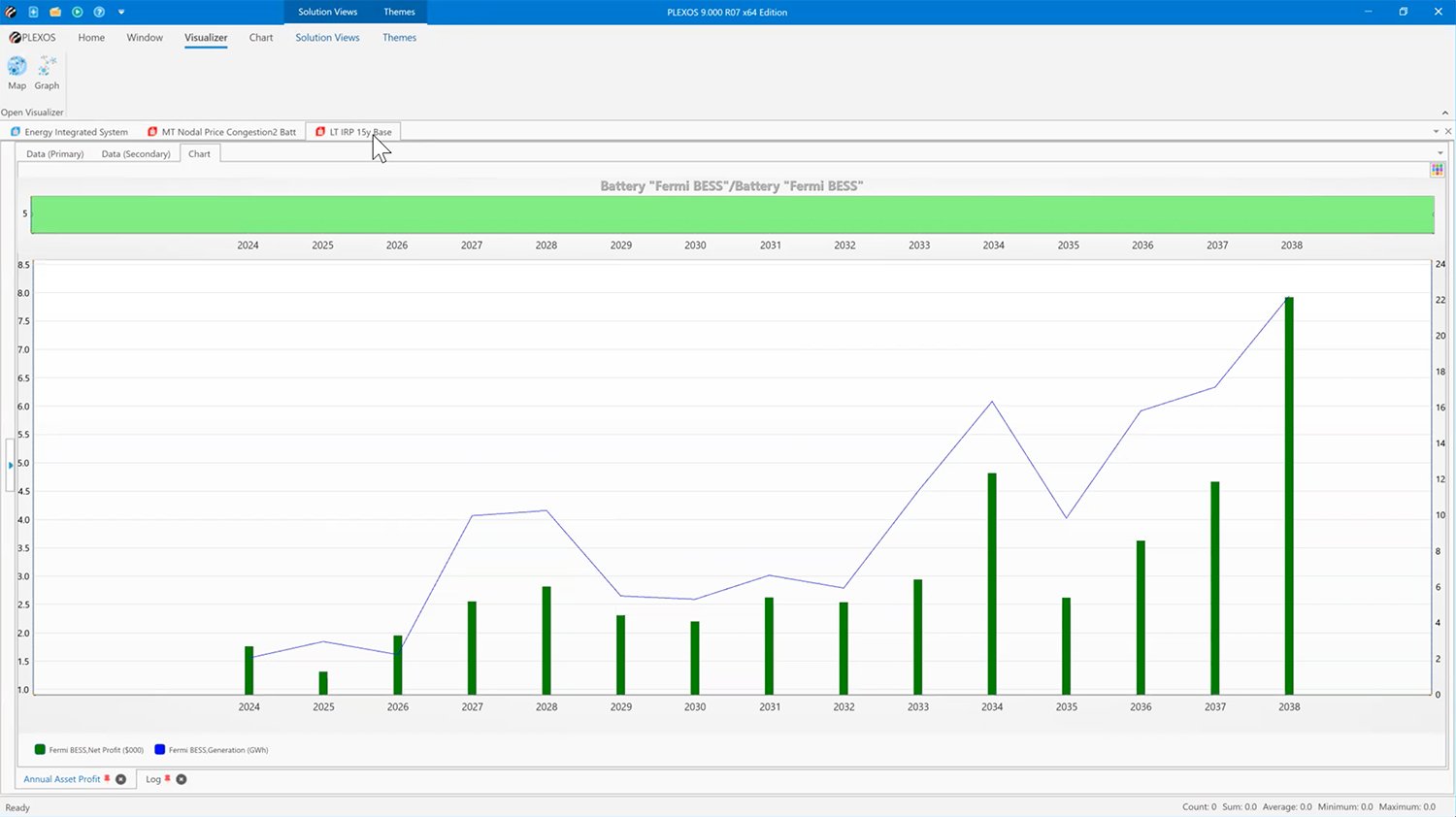

Finally, to understand the net return on the battery and enable you to set a valuation for the asset, we run the model over a multi-year horizon; in this case, 15-years. Here annual profit is represented by green columns and total generation by the blue line. In all 15 years, we see a positive net return. .

This use case featured model runs in PLEXOS over the short term to determine how the battery is being operated and long term to determine profit. Analyzing each of these runs shows that PLEXOS is operating the battery in a way that maximizes revenue from arbitrage opportunities and this operation yields a positive net revenue for the battery.