Portfolio Risk Assessment

Are you concerned about the increasing percentage of merchant revenue and cash flow required to support loan repayments? PLEXOS supports financial institutions and commercial lenders by effectively assessing portfolio risk and analyzing project cash flow for your loan portfolio.

As the energy market continues to develop and banks loan on utility scale renewable projects, quantifying and assessing risk is more important than ever. Energy Exemplar helps lenders understand project risk and evaluate loans in their portfolios more accurately than ever before.

- 20+ year price forecast

- Over 26,000 generators with unique operating characteristics

- Approximately 120,000 nodal buses modeled

- 43 natural gas hub forecasts for gas generators

- Plant-specific coal forecasts

- Up-to-date demand forecasts created from ISO and other available data

- Solar rating factors for fixed and tracking axis technologies

- Unique hourly wind shapes for 95 wind regions with three unique wind classifications for each configuration

Accurate portfolio risk assessment requires a holistic and integrated view of energy markets (including electricity, natural gas, water and, transportation) and an understanding of how each facility within a portfolio impacts the entire portfolio.

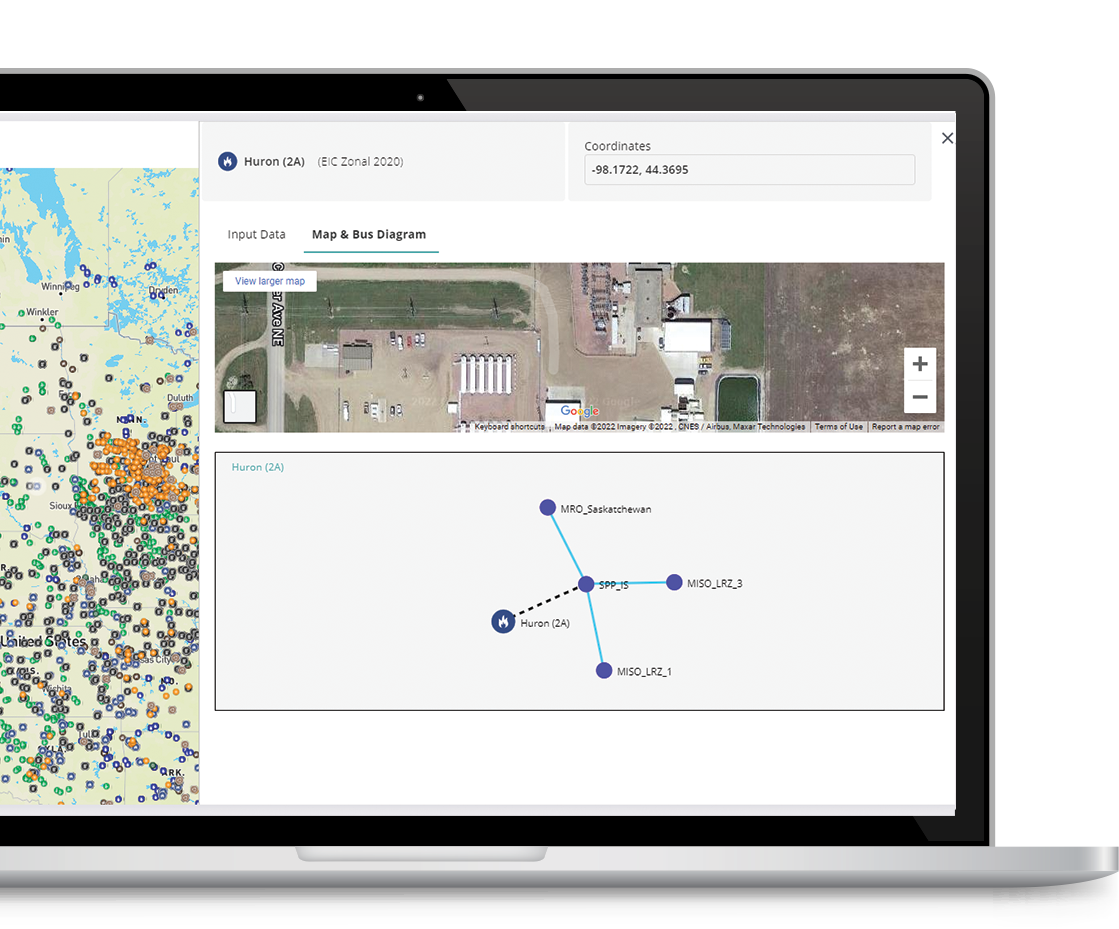

PLEXOS provides the power to understand the entire energy topology in North America and geographically map every project in your portfolio. Understand how new projects can complement or interfere with existing portfolio revenues—model gas price fluctuations to plan operating costs or analyze site-specific distribution and transmission levels.

In this scenario, we assume that revenue is a function of market price and generation profile. We then run a Monte Carlo simulation and create a histogram around these two factors.

After selecting an expected price and generation profile, we input a standard deviation to determine the level of uncertainty we expect from the profile.

PLEXOS runs a Monte Carlo sensitivity analysis to generate the portfolio's risk probabilities. The resulting histogram shows the likelihood of revenue including best- and worst-case revenue projections.

You can assess the projected revenue probabilities across an entire lending portfolio, a geography, or individual asset.