1 min read

Navigating Market Volatility with PLEXOS: A Data-Driven Approach

The global shift toward renewables is reshaping the energy system, bringing new levels of complexity, uncertainty, and interconnection. Prices...

In the last several years, gas has become essential to the operation of a reliable energy grid. Internationally, there’s agreement that we need to reduce carbon emissions and transition to cleaner energy sources. However, the means of accomplishing this have not been fully ironed out. While utility scale storage is coming online rapidly, the implementation has not come fast enough to balance out intermittent renewable energy sources. According to BCG, larger quantities of renewable energy among generation stacks are leading to increased volatility in power markets worldwide due to the fact solar and wind do not always produce during periods of peak demand – such as in the evening, or during extreme weather, for example.

The reality is that as societies, we have become extremely dependent on reliable energy. We need it to heat and cool our homes, store our food, and to perform our jobs. As the clean energy transition marches onwards, it has become apparent that natural gas will be critical to maintaining energy reliability. Although natural gas is not a clean energy source, it is a much cleaner source of energy than coal, and it is not reliant upon the sun shining or the wind blowing. However, as recent events have proven, this does not mean that natural gas is an energy source we can rely upon 100% of the time.

In 2021, extreme cold weather event, Storm Uri, led to outages across the United States. The ERCOT market in Texas was most significantly impacted by the unusually cold weather. All generation sources experienced outages – from solar, to wind, to natural gas. Winterization that occurred following a similar winter storm in 2011 proved inadequate as wind turbines, pipelines, coal piles, and well-heads froze, resulting in severe outages that caused significant loss of life.

More recently, the Russian invasion of Ukraine has wreaked havoc on natural gas markets internationally. Likely in retaliation to sanctions, the Russian government-owned Gazprom first slashed the Nord Stream Pipeline’s capacity to just 20%, and has now halted flows completely. Because gas has become a critical source of energy as nations transition to cleaner energy sources, the European Union has been left in a pinch. As winter approaches, European nations are being forced to evaluate alternate energy sources, acquire gas elsewhere, attempt to store more gas, and limit usage.

The impacts of the E.U.’s energy shortage reach far beyond its shores. Less developed countries such as India, Pakistan, and Bangladesh are already suffering power shortages as natural gas supplies dwindle without Russia’s cooperation. Australia, a significant exporter to Asian and Pacific countries, will be tightening their exports on the spot market to protect their east coast’s energy supply.

Meanwhile, the United States has stepped in to help fill the gap, becoming the largest exporter of LNG in the world. Meanwhile, the U.S. Freeport gas export facility shut down on June 8th, and is not expected to return to service until November. So, no matter how high gas prices may rise, the U.S. is not currently in a position to export larger quantities of gas. In conjunction, U.S. gas inventories are about 12% lower than the five-year average for this time of year.

As nations attempt to meet clean energy targets while providing their citizens with reliable, affordable electricity amid a war, it has become apparent how connected global gas markets truly are. There are a variety of unknowns as we move forward into the future – How long will the war last? What new technology will be developed? What outages and constraints will impact global and local natural gas supply and pricing? Will coal and nuclear suffice to meet natural gas demand, and thus drive prices down? What governmental policies will come into effect?

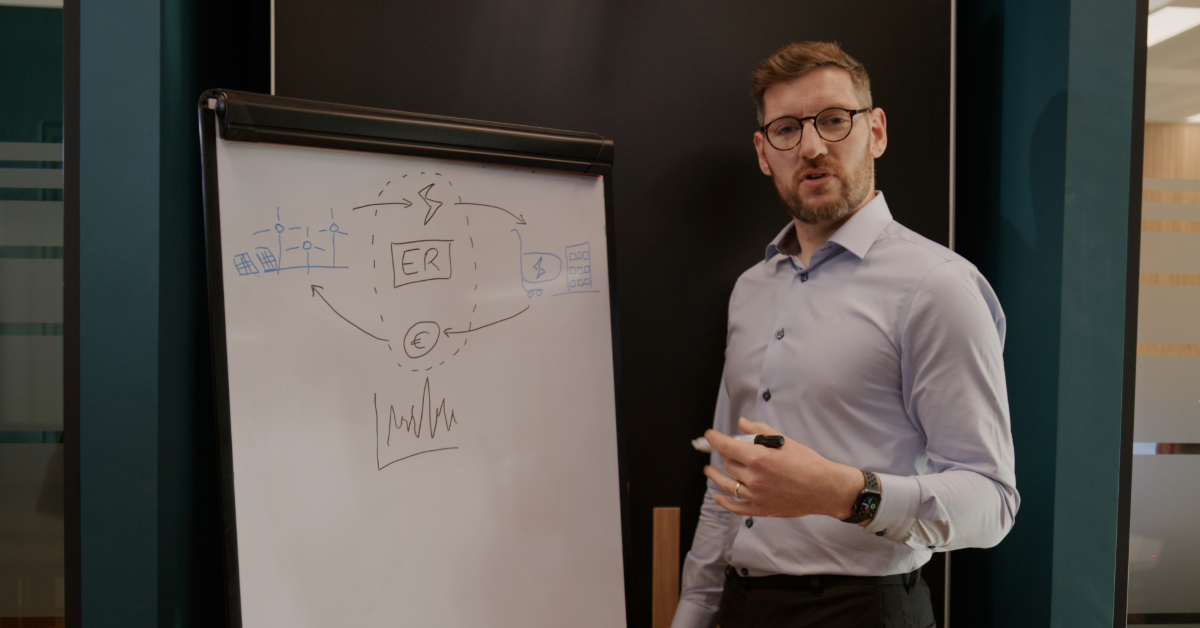

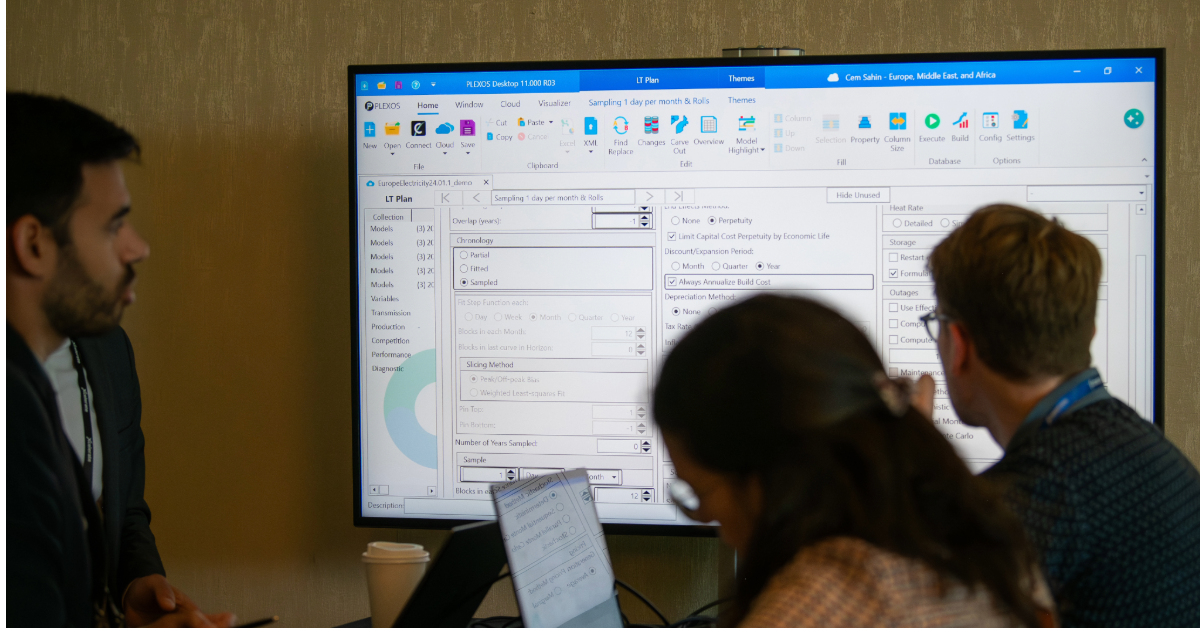

In this very fluid and uncertain environment, anyone with a stake in natural gas needs a holistic model to plan for a variety of scenarios, make the best investment decisions, and operate with confidence. Energy Exemplar’s industry leading PLEXOS modeling software, combined with a fundamental North American gas dataset, delivers transparency and actionable insight to gas market participants. With visibility into all the components of the North American gas infrastructure, gas professionals can evaluate a variety of scenarios, forecast pricing and congestion, and incorporate different gas scenarios into their IRP process. A transparent, single source of truth will prove essential for those with a stake in the gas industry to make informed decisions that best serve their unique stakeholders and objectives. To learn more about Energy Exemplar’s North American fundamental gas dataset, click here.

1 min read

The global shift toward renewables is reshaping the energy system, bringing new levels of complexity, uncertainty, and interconnection. Prices...

In Part 1 of this blog series based on our recent webinar, Harnessing the Winds of Change: The Future of Green Energy in a Turbulent Present, we...

ENTSOG and Energy Exemplar sign a multi-year licence agreement for the PLEXOS integrated power and gas energy simulation platform.