Shaping Ireland's Energy Future: EirGrid and Mott MacDonald's Use of PLEXOS® to Power Tomorrow's Energy Scenarios

EirGrid and Mott MacDonald: Preparing Ireland's power system for a net-zero future

3 min read

Team Energy Exemplar

:

April 11, 2023

Team Energy Exemplar

:

April 11, 2023

Achieving net zero emissions by 2050 will require a complete transformation of the global energy system. In the IEA's pathway to net-zero, almost 90% of global electricity generation comes from renewable sources, with solar PV and wind together accounting for nearly 70%. Renewable energy development is, and will continue to be, key to achieving net zero targets worldwide.

However, when optimally integrating utility scale renewables into the power grid, various issues can impact a project's reliability, feasibility, and profitability. These issues are, in many cases, rather intrinsic. For example, project feasibility is impacted by the project's ability to serve load reliably. Further, the feasibility of the project will have an impact on profitability. The following elements are essential to consider if you want to have an optimal renewable integration strategy:

To start, you’ll need to identify the required modeling capabilities to address the critical issues of optimal renewable integration. The following elements are essential to developing a profitable renewable integration strategy:

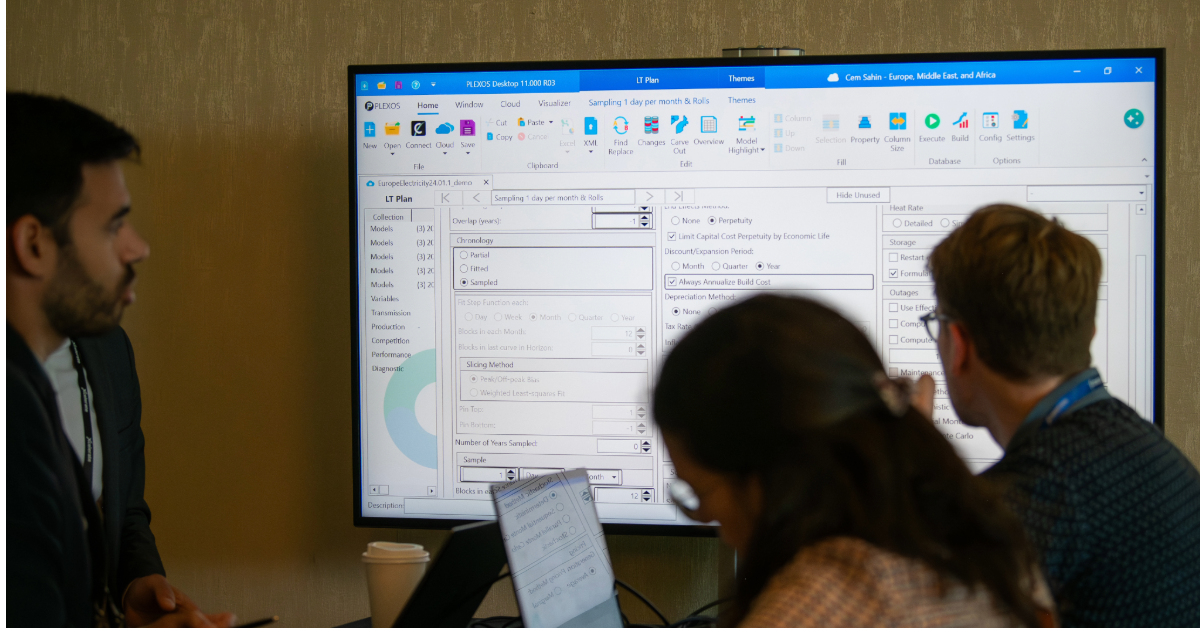

All the identified modeling capabilities require departments to work together efficiently, PLEXOS provides the enterprise platform that streamlines your operations to make investment decisions faster and with greater confidence.

Watch our on-demand webinar, Optimal Strategies for Renewable Integration, to learn more about best practices for planning and operations modeling processes related to renewable and hybrid energy projects.

EirGrid and Mott MacDonald: Preparing Ireland's power system for a net-zero future

Energy Exemplar recently participated in the panel Electric Power Markets – Role of Renewables & Environmental Trading at the Platts Nodal Trader...

In Part 1 of this blog series based on our recent webinar, Harnessing the Winds of Change: The Future of Green Energy in a Turbulent Present, we...